Every business needs strong financial management, but not every business can or should build a full in-house accounting team. Accounting errors, late reports, or missed tax filings can seriously damage a business. But managing accounting in-house can be overwhelming, especially when resources are limited. That’s where outsourcing changes the game. By outsourcing accounting functions, businesses gain access to professional-grade financial services without having to hire, train, or manage an internal team.

What Does an Outsourced Accountant Do?

An outsourced accountant is a financial professional or team that provides accounting services remotely, typically through an outsourcing firm or managed services provider. They can perform the full range of tasks you’d expect from an internal accounting team, but they do so virtually and often at a fraction of the cost.

Unlike a traditional employee, an outsourced accountant usually works with several clients and uses cloud-based systems to manage accounts. They can integrate into your existing processes or help you build better ones. Their work can range from handling day-to-day transactions to delivering high-level financial strategy.

Key Functions Include:

- Bookkeeping: Recording transactions, categorizing income and expenses, and reconciling bank statements to ensure all records are accurate and up-to-date.

- Accounts Payable & Receivable: Managing outgoing payments to vendors and incoming payments from customers, including invoice tracking, follow-ups, and dispute resolution.

- Payroll Processing: Handling employee compensation, including salary calculations, tax deductions, benefit management, and regulatory filings.

- Financial Reporting: Preparing and delivering essential financial documents like balance sheets, income statements, and cash flow reports.

- Tax Compliance: Ensuring your business adheres to local, state, and federal tax laws. They can also manage quarterly tax estimates and end-of-year filings.

- Budgeting & Forecasting: Analyzing past financial data to help project future revenue, costs, and capital needs.

These professionals work remotely but use secure cloud platforms to manage your books just like someone sitting in your office would.

What Is the Scope of Outsourced Accounting?

Outsourced accounting isn’t limited to data entry or payroll processing. It can be as broad or as specialized as your business needs. Whether you’re a startup in growth mode or an established business optimizing efficiency, outsourcing lets you tailor the accounting support you need without committing to a full-time staff.

The scope of outsourced accounting can vary by provider but generally includes everything from transactional services to strategic financial leadership. Many firms offer tiered services, letting you start small and expand as your needs evolve.

Full-Service Outsourcing Can Include:

- Transaction-level work: Bookkeeping, reconciliations, bank feeds.

- Operational accounting: Payroll, payables, receivables.

- Managerial accounting: Budgeting, forecasts, KPI tracking.

- Compliance accounting: Tax prep and filing, audit readiness.

- Controller services: Month-end close, financial statement accuracy.

- CFO advisory: Strategy, planning, financial modeling.

Why Do Businesses Outsource Their Accounting Functions?

Businesses outsource accounting for a variety of practical reasons, all of which come down to efficiency and access. From cost savings to specialized expertise, outsourcing allows organizations to do more with less, while maintaining or improving the quality of their financial oversight.

What the Top Advantage of Outsourcing Accounting Functions?

If you had to pick one clear advantage, it would be access to professional-grade accounting at a lower cost and commitment. Outsourcing allows companies to instantly raise the standard of their financial operations without going through lengthy recruitment or training processes.

You gain continuity, standardized reporting, and fewer disruptions from turnover or internal delays. And because outsourcing providers operate in a service model, they’re driven to deliver consistent performance, value, and transparency, often with service level agreements (SLAs) built in.

Best Accounting Functions to Outsource

Not every business wants or needs to outsource all their accounting. But certain functions, especially those that are repetitive, regulatory-driven, or require a high degree of accuracy, are ideal candidates.

These functions are usually the first to be outsourced because they free up internal resources, reduce risk, and benefit most from external expertise and automation.

Top Functions to Outsource:

- Bookkeeping: Time-intensive but repetitive and rules-based.

- Payroll: Mistakes here can lead to penalties and disgruntled employees.

- Accounts Payable/Receivable: Critical for cash flow, and very process-driven.

- Tax Preparation: One of the riskiest areas to DIY. Compliance demands are complex, and mistakes are costly.

- Month-End Close: Essential for financial accuracy and stakeholder reporting. Delays here can skew decisions and forecasts.

Best Practices When Outsourcing Accounting Functions

Like any business relationship, the success of outsourcing depends on how well it’s implemented. Jumping in without a plan can lead to mismatched expectations and poor results. But with the right approach, outsourcing can be seamless and powerful.

These best practices help ensure a smooth transition and lasting value from your outsourcing arrangement.

1. Define Clear Objectives

Know what you want. Whether it’s reducing cost, increasing reporting speed, or improving compliance, you need clear goals.

2. Vet the Provider Carefully

Check credentials, industry experience, client reviews, and data security protocols.

3. Start with a Pilot

Test the relationship with one function before going all in.

4. Use the Right Tools

Cloud-based accounting platforms improve collaboration, speed, and transparency. Look for providers familiar with platforms like QuickBooks, Xero, NetSuite, or Zoho Books.

5. Establish Communication Cadence

Clear communication is crucial. Weekly check-ins, monthly reports, and quarterly reviews help maintain alignment.

6. Focus on Compliance and Security

Make sure the provider adheres to local and international standards like GDPR, SOX, and IRS regulations.

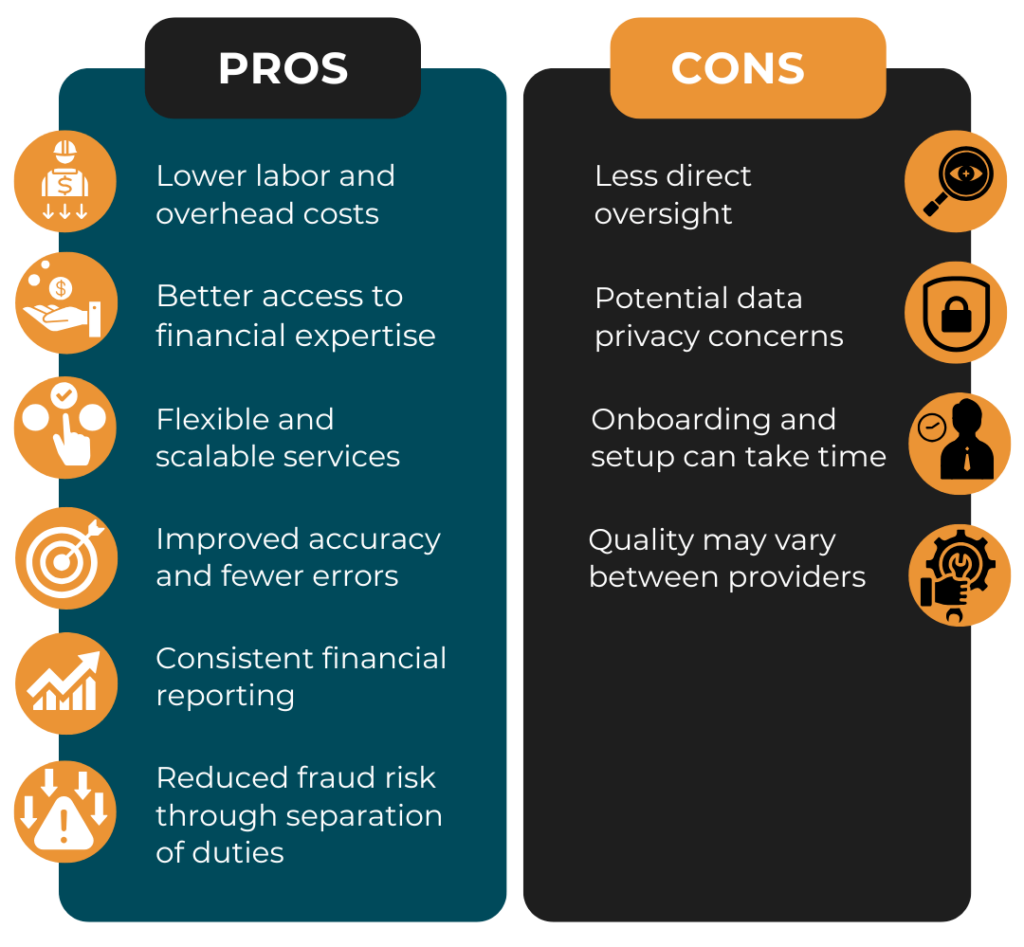

Pros and Cons of Outsourcing Accounting Functions

Outsourcing accounting has clear upsides, but it also comes with considerations. It’s not a silver bullet for every company, and success depends on aligning the provider’s capabilities with your needs and expectations.

Here’s a balanced look at the main benefits and potential drawbacks.

You don’t have to waste time hiring, training, or worrying about compliance anymore. At Guided Outsourcing, our accounting professionals handle everything from daily bookkeeping to CFO-level insights — all tailored to your business.

Let’s talk. Schedule a free discovery call and get a custom accounting solution that actually works for your business.

Conclusion

Outsourcing is a smart, strategic move that puts your financial operations in the hands of experts while saving time, money, and stress. Whether you’re a startup that needs basic bookkeeping or a growing business looking for CFO insights, outsourcing can meet you where you are and grow with you.

Guided Outsourcing brings the people, process, and platforms together, so you can focus on your business, not your books.